Form 2848 Instructions For IRS Power Of Attorney – Have you ever at any time puzzled what IRS Form For Power Of Attorney Form 2848 are? This isn’t an unheard of question. It really is no surprise this document is so essential inside the legal discipline. You might be only some clicks absent to comprehend it better. It is an excellent point you happen to be currently here. This informative article will clarify exactly what the doc is employed for and a couple of other facets which make it authorized. Get out your pen and a jotter, you are going to learn one thing new.

What are the IRS Form For Power Of Attorney Form 2848 and How Can They Function?

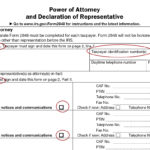

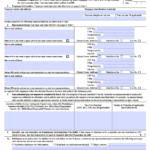

IRS Form For Power Of Attorney Form 2848. A power of attorney, also referred to as POA, is really a lawful doc which provides a person the power to act to the signee. It really is a doc that lists the signee’s authorization and is provided towards the person named on it to complete a certain factor.

This form may have a very deadline. This means that the IRS Form For Power Of Attorney Form 2848 have a cut-off date. The restrict may be the time that the power of attorney forms may be used to grant a person the power to act for them.

Which Are The Rewards of Placing IRS Form For Power Of Attorney Form 2848?

Even for your next next, we don’t really know what goes to happen to our life. You are going to need a person to manage your enterprise in case you’re incapacitated. This really is similar to a will however the power-of-arrangement form applies only if you and the signee remain alive.

This form is used to authorise a specific party to consider a call with your behalf for a specified purpose. The form may be used in the event the signer is incapacitated. It’ll also be valid if he or she is not able to become present to sign crucial paperwork, transactions or other lawful matters.

What Happens In The Event You Don’t Possess a IRS Form For Power Of Attorney Form 2848?

IRS Form For Power Of Attorney Form 2848. That’s the short reply to your issue. You will not possess a legal approved party to assist you in almost any way, even when you really are a beloved one like your spouse or youngsters. It really is imperative that you have a valid power of attorney in place all the time. It is therefore important to really know what sort of power of attorney you should use.

How Do I Create a Power of Attorney Form?

These seven straightforward measures can help you make it occur.

- You must admit why you’re requesting power of attorney forms.

- Then, determine what type of doc that you would like to produce.

- You’ll be able to review differing kinds of power of attorney online.

- Ask for the consent of the person/party that you simply truly feel is reputable to act as your agent.

- Get started with all the document.

- Sign the doc.

- Ultimately, make certain to help keep your doc secure.

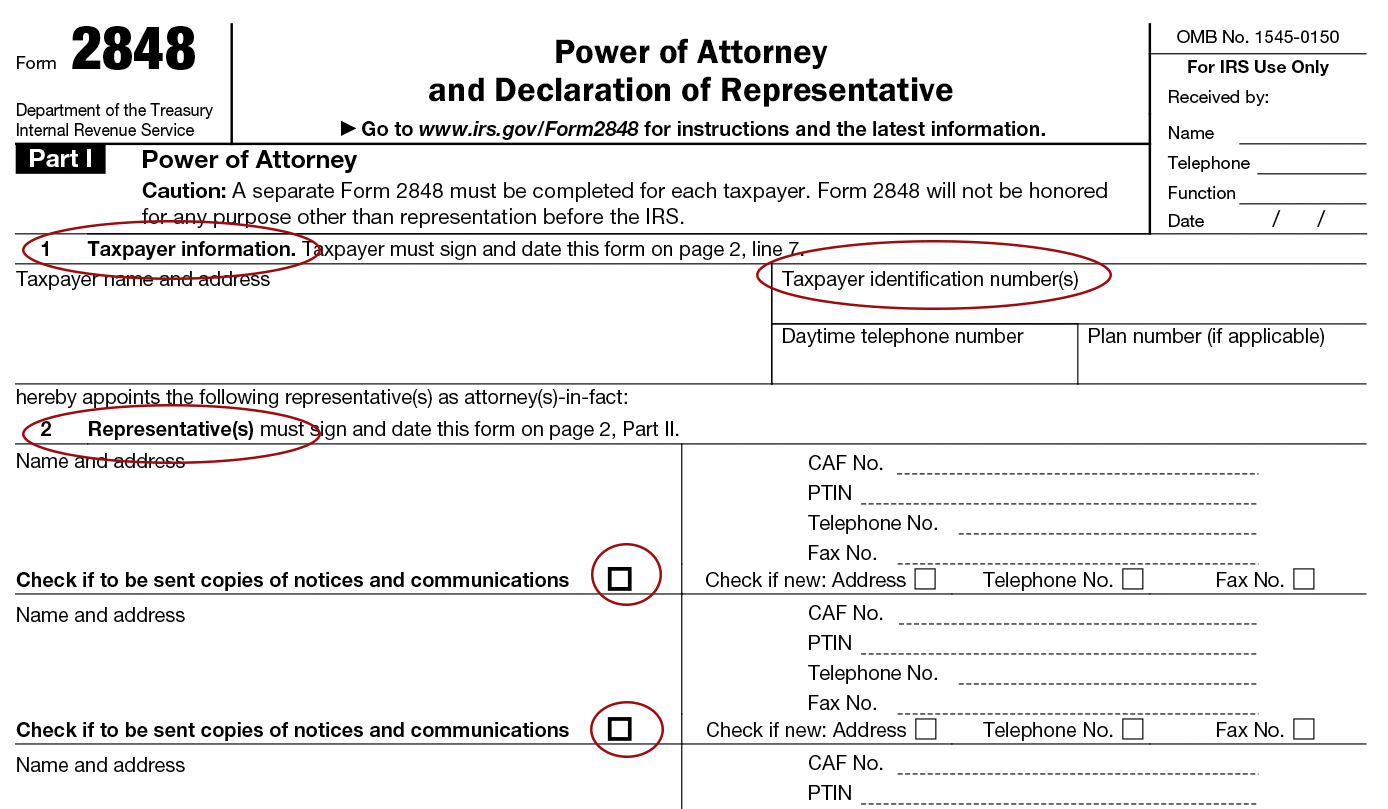

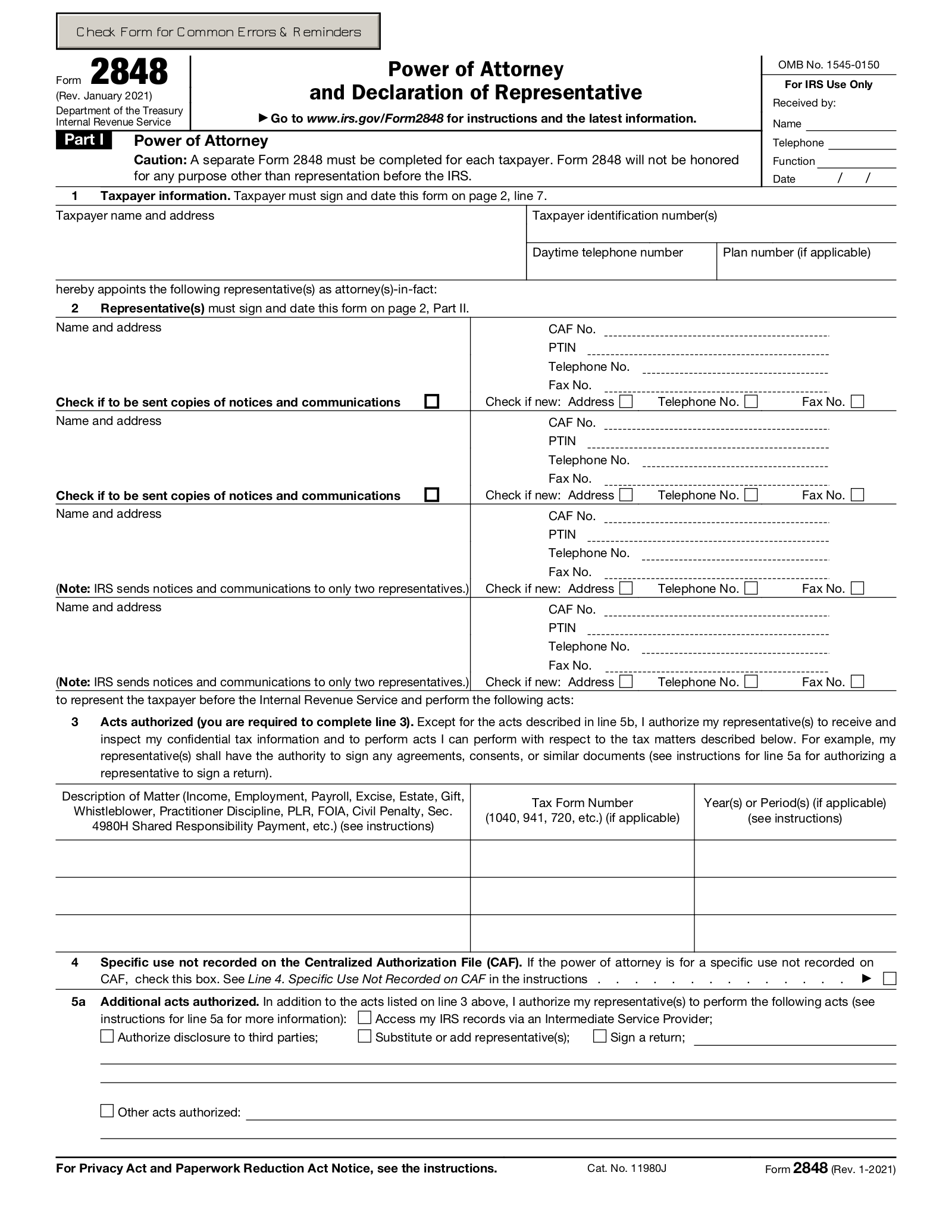

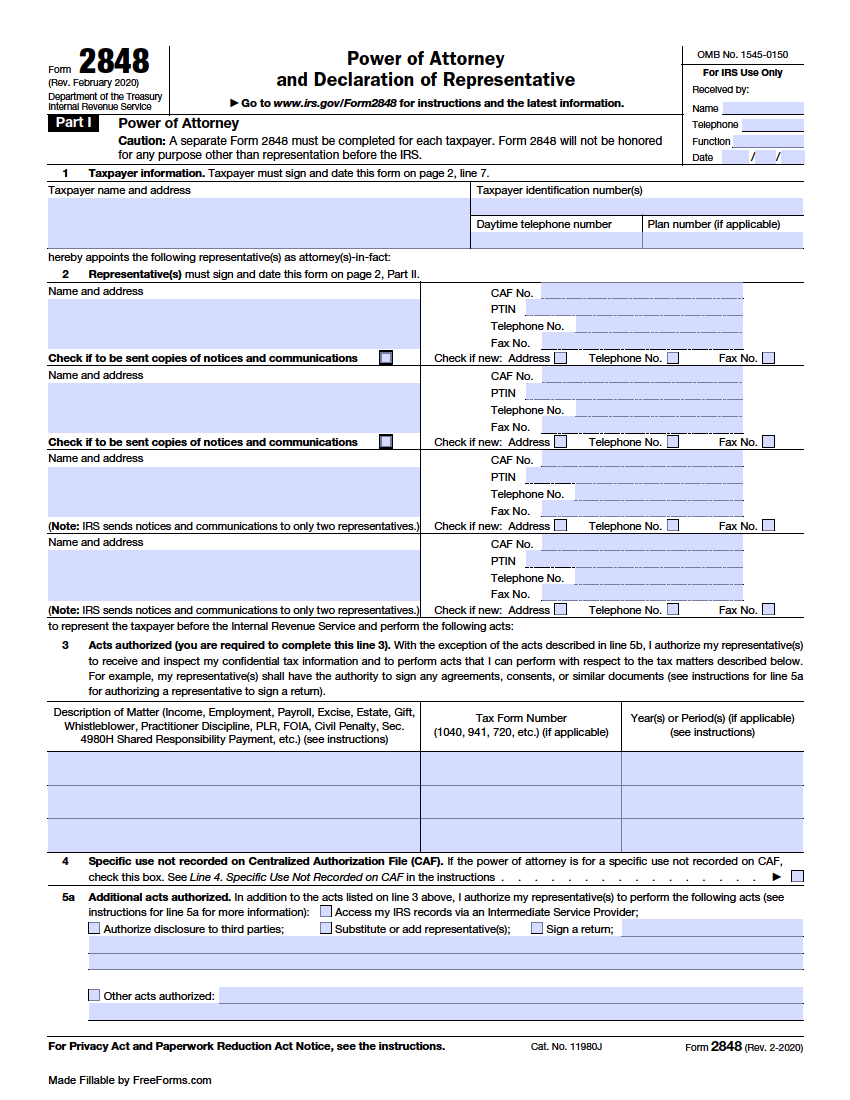

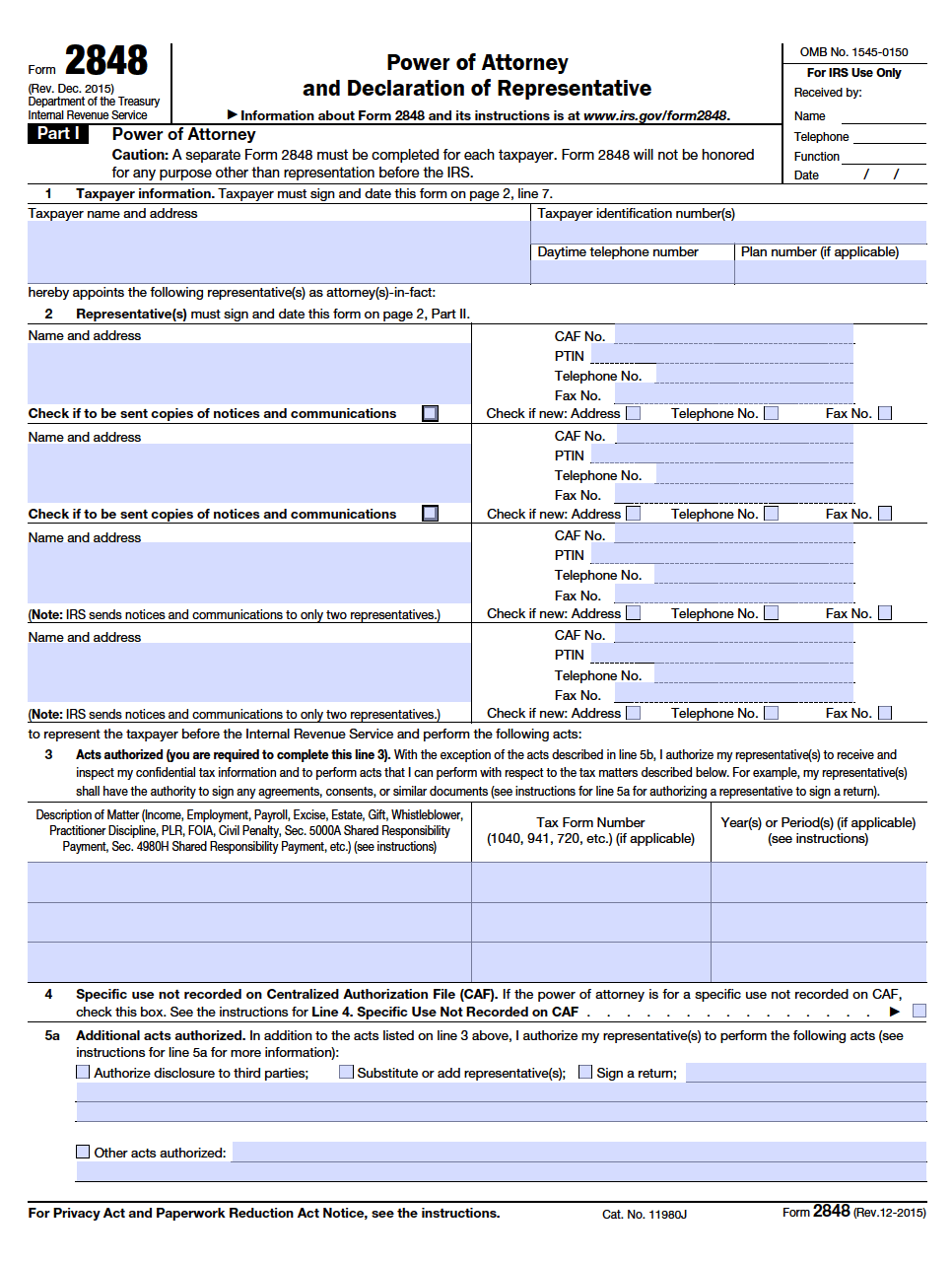

IRS Form For Power Of Attorney Form 2848

Power of Attorney Forms Printable Downloads PDF

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...