Free IRS Power Of Attorney Form 2848 Revised Jan 2018 – Have you ever puzzled what IRS Power Of Attorney Form are? This is not an uncommon issue. It really is no surprise that this doc is so important in the authorized area. You might be just a few clicks away to know it far better. It is a good factor you happen to be already right here. This informative article will clarify exactly what the doc is used for and several other facets which make it legal. Get out your pen and a jotter, you will discover some thing new.

What are the IRS Power Of Attorney Form and How Do They Perform?

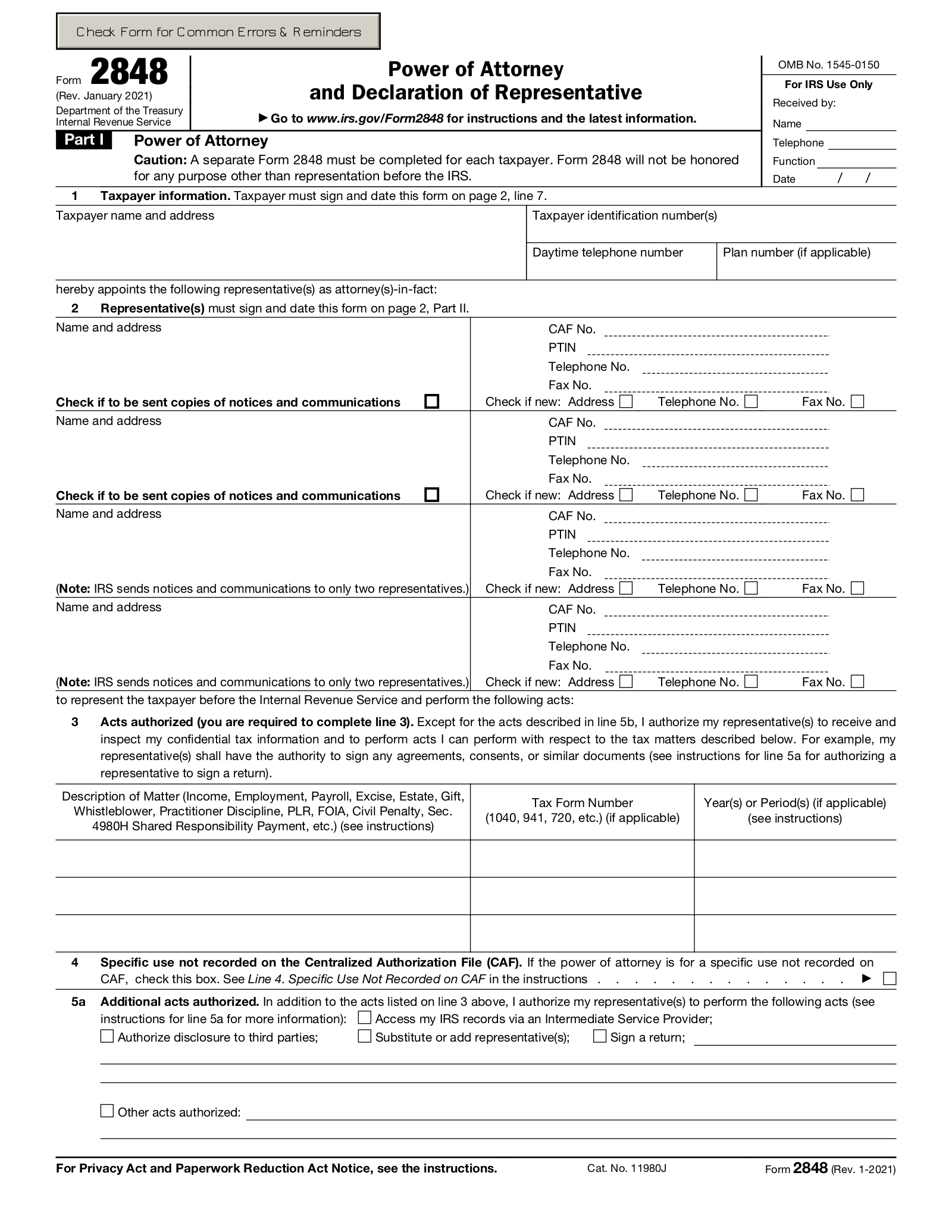

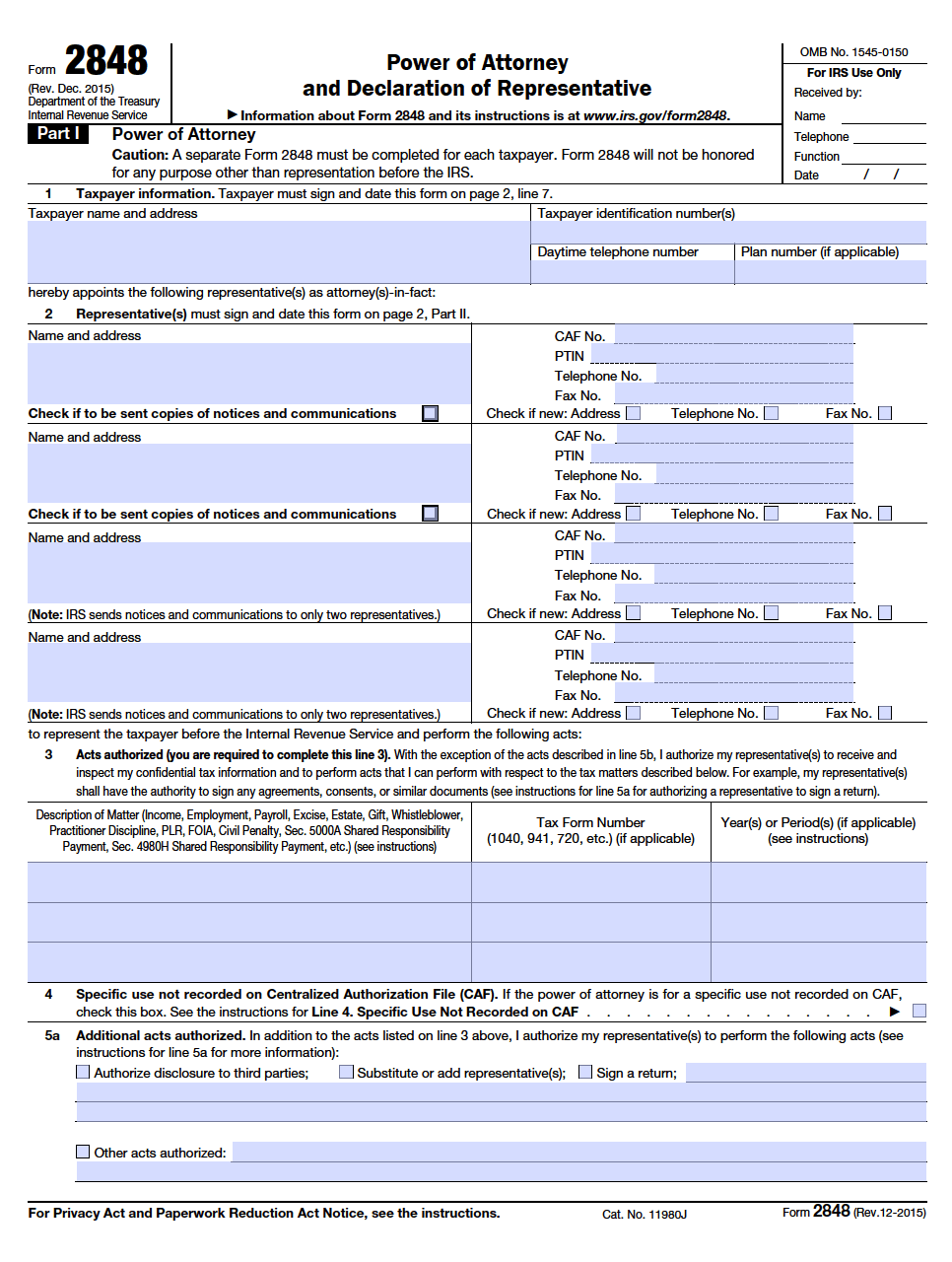

IRS Power Of Attorney Form. A power of attorney, also referred to as POA, is actually a legal document which provides somebody the flexibility to act for the signee. It is a doc that lists the signee’s authorization and is provided to the individual named on it to complete a specific point.

This form might possess a cut-off date. Because of this the IRS Power Of Attorney Form have a very cut-off date. The restrict is the time which the power of attorney forms may be used to grant somebody the flexibility to act for them.

What Are The Benefits of Placing IRS Power Of Attorney Form?

Even to the subsequent second, we don’t understand what goes to happen to our lives. You’ll need someone to handle your business in case you’re incapacitated. This is similar to a will but the power-of-arrangement form applies only if you and the signee continue to be alive.

This form is used to authorise a particular party to consider a choice on your behalf for a specified purpose. The form may be used in the event the signer is incapacitated. It will also be legitimate if he or she is unable to become current to indicator important paperwork, transactions or other lawful issues.

What Happens In The Event You Don’t Possess a IRS Power Of Attorney Form?

IRS Power Of Attorney Form. That is the short reply to your query. You are going to not have a lawful approved party to assist you in any way, even though you really are a loved one like your husband or wife or kids. It’s imperative that you have a legitimate power of attorney in place all the time. It’s consequently vital that you understand what kind of power of attorney you need to use.

How Can I Produce a Power of Attorney Form?

These seven straightforward steps will allow you to allow it to be take place.

- You need to admit why you might be requesting power of attorney forms.

- Then, determine what type of doc that you’d like to create.

- You’ll be able to review differing types of power of attorney online.

- Request for your consent of the person/party that you simply truly feel is reputable to act as your agent.

- Start with the doc.

- Sign the document.

- Finally, ensure to keep your document safe.

IRS Power Of Attorney Form

Power of Attorney Forms Printable Downloads PDF

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...